Belgium scores exceptionally in Logistics Performance Index… but there is room for improvement

For the first time since 2018, the World Bank published its Logistics Performance Index (LPI) in April. This is a benchmarking report of the logistics efficiency of every country in the world, especially in terms of international trade and traffic. Belgium scored very well again, yet our country drops from third to seventh place. The reason: several countries such as Singapore, Finland and Denmark made more progress.

The LPI is in its seventh edition. The tool was created to enable national policymakers and private companies to identify priorities for improving their international trade and logistics infrastructure (especially ports, airports and multimodal hubs). The benchmark is compiled based on a survey of international logistics operators, such as freight forwarders and express carriers. The ranking is published every two years, but it took a bit longer this time, due to the COVID crisis and the dramatic disruption of global supply chains during the first semester of 2022.

The World Bank took advantage of this delay to make some methodological adjustments. Therefore, the 2023 results are not one-to-one comparable with those of 2018. Nevertheless, the scores remain particularly relevant.

Six indicators

Each country is assessed (with a score out of 5) based on six indicators:

- The efficiency of customs and the management of customs procedures

- The quality of trade- and transport-related infrastructure

- The efficiency of obtaining competitively priced international shipments

- The competence and quality of logistics services

- Ability to track and trace shipments digitally

- The frequency of shipments that reach their destination within the specified or expected timeframe

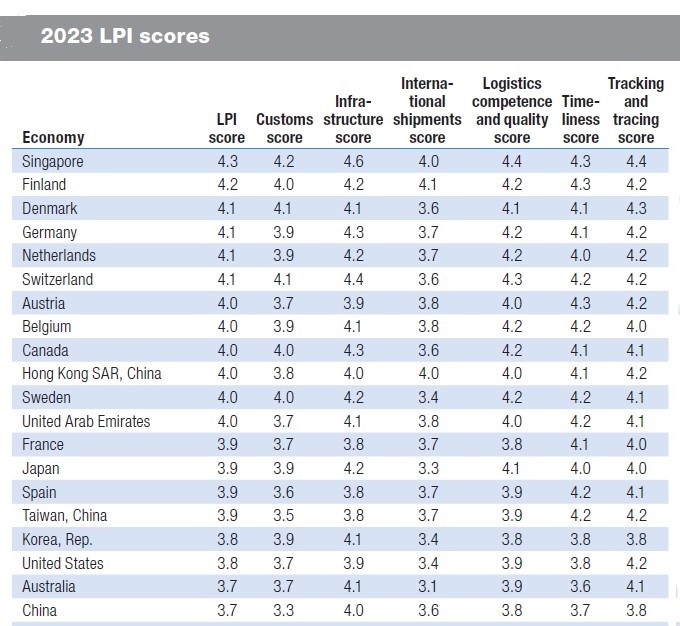

In 2018, Belgium ranked third in the LPI with an overall score of 4.04, behind Germany (4.20) and Sweden (4.05). It was followed by Austria (4.03), Japan (4.03), the Netherlands (4.03), Singapore (4.00) and Denmark (3.99).

This year, two countries are passing over Germany, whom was in first place back in 2018. The new leader is Singapore (4.3), followed by Finland (4.2). Denmark, Germany, the Netherlands and Switzerland share third place (with 4.1). Belgium shares fourth place with Canada, Hong Kong, Austria, the United Arab Emirates and Sweden.

The difficulty in comparing with 2018 is partly due to the fact that the scores do not count two decimal places, but one. As a result, there are more ex-aequos.

Good and not-so-good news

For all six criteria, Belgium is among the world leaders. Compared to 2018, our country improves its scores in five out of six cases, though this is not always rewarded with place gains. A few countries – most notably Singapore and Finland – performed even better.

Belgium improves on two of the six criteria: the efficiency of customs and customs procedures (from 3.66 to 3.9) and infrastructure (3.98 to 4.1). This moves us from 14th to 7th place and from 14th to 9th place, respectively. Nevertheless, there is still work to be done in these regards, especially if we seek to be among the top 5 on the previously mentioned points.

Belgium is losing first place for two indicators: the cost of international shipments and ‘timeliness’ (reaching the final destination quickly). In both cases, we are now in fourth place, even if we perform- better on timeliness (from 4.05 to 4.2). In terms of international shipments, there is a slight drop, from 3.99 to 3.8.

Belgium scores even better in terms of the quality of logistics services (from 4.13 to 4.2), yet we lose one place (from 2 to 3).

The biggest point for Belgium to improve is progressing track & trace capabilities. Our country remains spot on (from 4.05 to 4.0) but does lose seven places: we decline from 9th to 16th place.

Companies are also in the lead

According to the World Bank, the indicators can be divided into two groups: three that are mainly under the government’s control (customs, infrastructure and competence) and three relating to the results of service provision, in which companies, therefore, have a role to fill: timeliness, cost of international shipments and tracking & tracing.

For the federal and regional authorities in Belgium, it is therefore essential to get our country into the top five in terms of customs and infrastructure.

For companies, boosting the track & trace score will be especially important, because 16th place is severely disappointing for a country like ours. The LPI report does not elaborate any further, but this could indicate that Belgian companies are relatively behind (compared to the frontrunners) in terms of digitising their operations. Incidentally, the same applies to more thorough digitisation of customs procedures.

Conclusion

Despite a slight drop in the ranking (which may be due to the slightly changed methodology), Belgium remains firmly entrenched in the top group of best logistics countries in the world. yet, some signals are problematic. If we seek to secure the future, both the government and companies need to invest even more in digitalisation.

Link: https://lpi.worldbank.org/sites/default/files/2023-04/LPI_2023_report_with_layout.pdf