The future of logistics automation in the Benelux

Automated storage and retrieval systems (ASRS), robotics, smart labels and autonomous mobile robots (AMR) are the technologies that will have the most significant impact on logistics operations in the Benelux. Research by Analytiqa also found out that many companies in the region are open to signing longer term contracts with logistics service providers in exchange for an investment in automation. The results of this research were bundled in a white paper: “Future of Logistics Automation in the Benelux”.

UPS Supply Chain Solutions (UPS SCS) and Frasers Property Industrial have undertaken to research the automation of logistics in the Benelux in collaboration with Analytiqa, a primary research and analysis company. They interviewed 54 senior executives – in both corporate and supply chain roles – in companies of all sizes across the technology, retail and industrial manufacturing sectors (not the 3PL).

As a result, they published a white paper summarising the current market position and providing an outlook for the demand for the automation of logistics operations in the region (*).

This white paper – of which we bring only a part of the main results in this article – can be downloaded here.

Current challenges

To better understand the factors driving demand for automation, the researchers first identified the challenges facing manufacturers and retailers in the management of their supply chains and logistics operations. The biggest challenges are inflation, energy, labour costs and staff shortages. Specifically for e-commerce, the two biggest challenges are managing consumer expectations for faster deliveries and affiliated recruitment.

The pandemic and the subsequent disruptions of the supply chains encouraged many companies to undertake a strategic review of their supply chain management. As a result, more companies are considering changes to their supply chain operations.

Almost 20% of respondents are considering outsourcing their warehouse operations. A similar share is considering bringing their warehouse operations in-house, whilst 7% are considering changing their outsourced logistics partner. The remaining 56% however are comfortable with their present supply chain choices.

The present level of automation

The researchers of Analytiqa also asked participating companies to what extent they already are using automation. They also analysed the type of processes they are automating and what prevents them from investing further.

Almost 20% of them are not at all automated, whilst 7% consider themselves highly of fully automated. Retailers were more likely to have invested in warehouse automation to date. 44% of them already have basic levels of warehouse automation in place such as mechanisation (automated conveyors) and 30% have a medium level of automation.

Researchers also found out that 15% of companies have invested in scan, print and apply; that 19% use smart labels; that 13% use automated storage and retrieval systems (ASRS); and that 11% use robotic process automation (RPA).

Many reservations remain

Whilst the vast majority of companies are investing in technology and automation, to at least basic levels, many reservations remain regarding their decisions to automate further. Their main concern is the return on invested capital (26%). Technology integration issues are noted by 24 % of the respondents: they consider them as a main operational risk. Concerns over potential system breakdowns was highlighted by 20% of companies as a barrier to investment in automation. Furthermore, 7% view disruption to their operations as a result of systems maintenance requirements as a reason for not automating. Concerns about the availability of cash to invest are very low (6%).

The researchers also found out that many companies are open to signing longer term contracts in exchange for an investment in automation: 32% would agree to such contracts and 58% say that they ‘would be willing to consider’ this approach.

Future impact

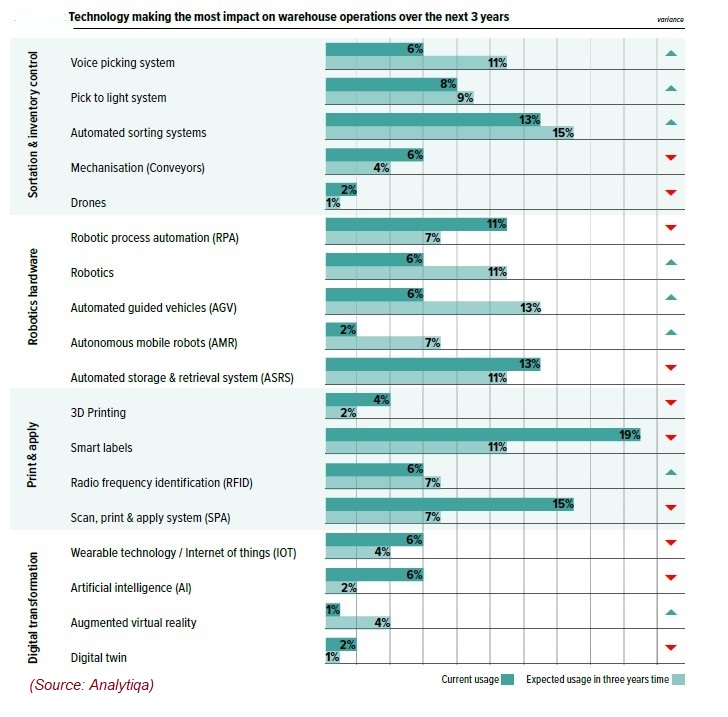

In the last – and main – part of this white paper, researchers identify which technologies will have the most significant impact on logistics operations.

Asking companies for a ‘global’ perspective beyond the confines of their own operations, 34% expect that ASRS will have a ‘game-changing’ or ‘big impact’ on logistics operations, as these systems will assist them to overcome the challenge of recruiting warehouse staff. Robotics and smart labels come next (both with 32%). Only a slightly smaller share expects the same of autonomous mobile robots (AMR).

With ASRS already viewed as a ‘standard’ automated solution by logistics operators, the Analytiqa research suggests that manufacturers and retailers are catching up to 3PLS in their ASRS adoption. It also notes that they may see outsourcing as an opportunity to deploy or access such solutions quicker.

Impact on their operations

Companies were also asked to identify the technology applications that will have the largest impact on their own warehouse operations now and over the next three years.

In the Benelux, 15% of respondents expect automated sorting systems to have the greatest impact on their own warehouse operations, compared to 13% that are currently employing such solutions. 13% of respondents forecast that automated guided vehicles (AGV) will have the greatest impact on their operations. With only 6% of respondents currently using such solutions, investment is likely to increase significantly in the short-term.

(Text continues under the figure)

Warehouse staff to be re-deployed

A constant theme throughout the research was the challenge warehouse operators face in recruiting staff. Automation of warehouse processes is seen as a key solution to this issue, but not necessarily as a short-term fix. 14% of companies do not expect to see any of their warehouse staff replaced by automated processes within the next five years, and 11% do not even think this will happen over the next decade.

However, the vast majority of respondents expect automation to replace warehouse staff only over the long term. Looking 10 years ahead, 56% of respondents believe their warehouse workforce will be reduced by a minimum 10% and a maximum of 40%.

According to the research, this does not necessarily equate to a reduction in staff numbers, as headcount is likely to migrate from warehouse operatives to IT specialists.

—

The authors of the white paper:

- Patrick Loos, Benelux Country Development Manager UPS

- Niek van Genugten, Senior Manager Business Development Frasers Property

- Mark O’Bornick, Director Analytiqa

The white paper can be downloaded here.