Warehouse automation market will resume growth in 2024

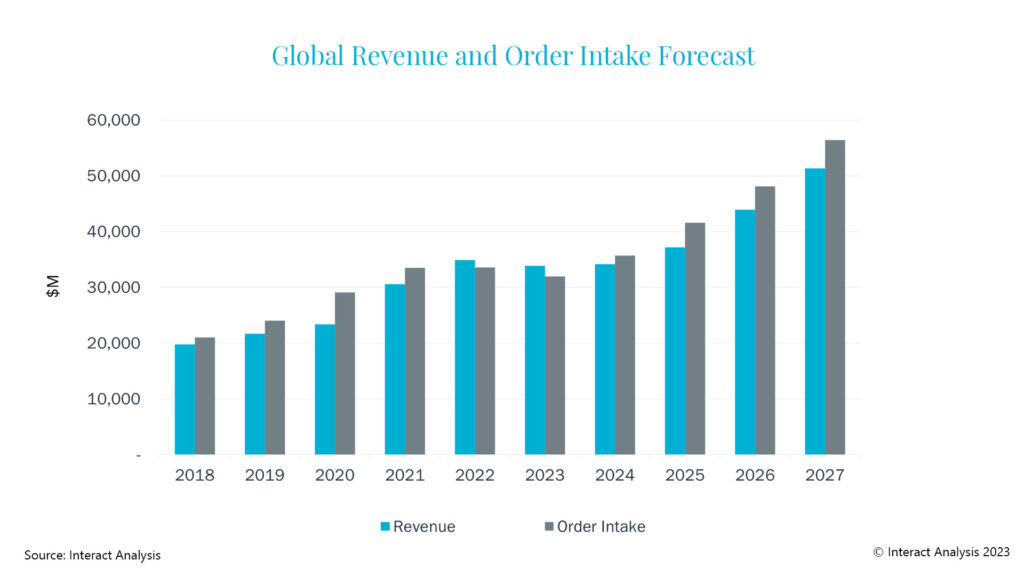

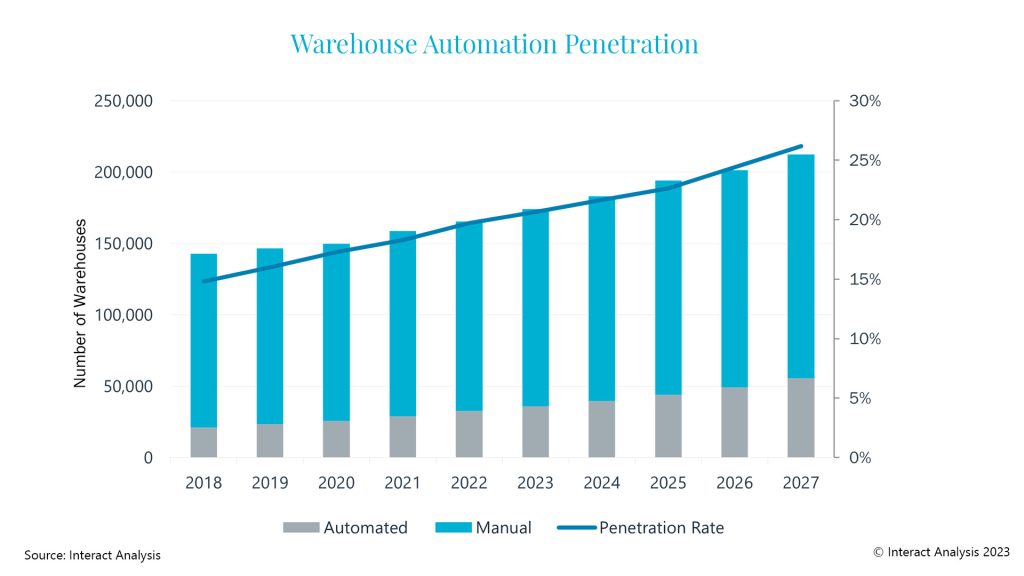

Global warehouse automation order intake will begin to grow again in 2024 after the market suffered a tough 2023, albeit at a low rate. From 2025 onwards, revenues are expected to return to double digit growth, according to Interact Analysis. The London based market intelligence firm also expects the demand for automation of warehouse operations to through to 2027, when one-quarter of sites (26%) will have some form of automation installed. In a separate evolution, AI may give automation a boost in 2024 as it speeds up software development.

In its latest research report (the 5th edition of its Warehouse Automation report), Interact Analysis states that as a result of the pandemic and record low level interest rates in 2019/2020, there was a significant increase in e-commerce orders which led to an uptick in warehouse construction and therefore, an increase in warehouse automation sales.

However, the slowdown of e-commerce sales and the rise of interest rates led to a decline in warehouse construction, which subsequently caused a corresponding slowdown in warehouse automation investments in 2023. Order intake for fixed automation contracted by around -8%, but order intake for mobile automation grew by 38% over the year, providing a buffer against the overall market decline.

The slowdown is being felt most in vertical markets with high exposure to e-commerce such as general merchandise, grocery, and apparel, states Chloe Starks, Account Manager at Interact Analysis. These are often referred to as ‘downstream verticals’ because they are downstream in the supply chain and closer to the consumer.

On the other hand, upstream verticals like durable manufacturing have performed relatively well, driven by the trend towards near-shoring and the resulting construction of factories in the US and Europe. The durable manufacturing sector in fact is expected to have been the fastest growing vertical market for warehouse automation in 2023, with a revenue growth of 6%.

Very modest growth in 2024

Following this overall slowdown in revenues in 2023, the global warehouse automation market will experience a weak growth in 2024 and return to high growth in 2025, according to Starks. “Overall, our projections for 2024 are more pessimistic compared with our previous forecasts. We expect interest rates to remain high next year, which will dampen warehouse construction”, she says. She expects a return to double digit order intake growth in 2025.

Brownfields drive the market

Rueben Scriven, Research Manager at Interact Analysis, notes that – besides the upstream vertical markets – brownfield sites are driving the market for warehouse automation.

“Greenfield sites are well suited for large and complex end-to-end solutions, while brownfield sites are better suited to smaller point solutions that automate particular workflows, such as mobile robots. Because the share of brownfield sites has now increased, the share of point solutions (relative to end-to-end solutions) has also increased. Therefore, automation vendors that can provide solutions for brownfield sites and distribution centre automation projects will fare well in the short term”, he says.

26% of warehouses to be automated by 2027

In an earlier report in May, Scriven analysed the medium-term market outlook. “Momentum is growing for automation of warehousing operations. This is expected to through to 2027, when one-quarter of sites (26%) will have some form of automation installed. This is a steep rise from just 18% at the end of 2021”, he says. According to him, this demonstrates how a number of key factors, including labour shortages and the e-commerce, is driving the market.

Although demand for end-to-end automation solutions experienced a dip in 2023 and should know only a small increase in 2024, he expects many companies to continue to spend on automation. He predicts that, also in the medium term, they will focus on their existing assets, rather than investing in new or larger automation projects.

Slowdown in warehouse building to be short-lived

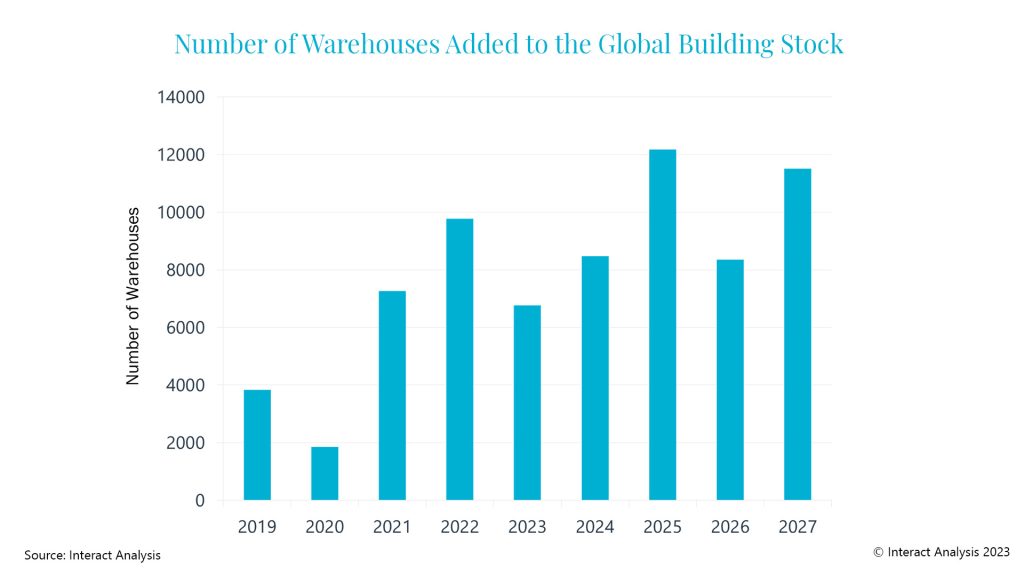

“Our analysis indicates the global economic downturn, high interest rates and the slowing trend towards e-commerce have hit warehouse construction hard, in particular fulfilment centers. As a result, the number of new warehouses added to global building stock is anticipated to drop from nearly 10,000 in 2022 to 6,700 in 2023, but still above pre-COVID levels”, he adds.

Scriven doesn’t think this 2023 dip in warehouse construction was due to an underlying lack of demand but was more the result of the current economic climate, high interest rates and the sheer volume of capacity added in 2021 and 2022. “With this in mind, the slowdown in warehouse building is likely to be short-lived”, he says.

E-commerce sales resume their growth

One of the reasons is that global e-commerce sales are projected to resume their growth and more than double over the five years to 2027, driving growth in global warehouse stock. A large proportion of them are expected to be direct-to-consumer fulfilment centers, which will require substantial automation and labour.

This represents a significant opportunity for warehouse automation vendors, particularly as labour costs are high, especially in Europe and North America.

“Despite the high growth forecast for warehouse automation systems, market saturation remains a long way off. For example, the ROI of an automated sortation system is high as a result of the increased throughput rates it offers compared with manual sortation, coupled with the potential to reduce labour costs and to fill skills gaps”, Scriven also states.

AI to speed the pace of automation in 2024

Another recent evolution might also boost the market for automation and robotics in logistics and manufacturing in 2024: the breakthrough of artificial intelligence in the past year. In a recent interview with supplychaindigital.com, Anders Beck, VP Strategy & Innovation at Universal Robots, expects AI to set a new pace of their development next year. “If software development has sometimes felt like digging with a shovel, the introduction of AI is like bringing two horses and a plough to the process,” he says.

According to Becker, 2024 will see software developments leading to new levels of sharing and reusability. “Imagine a world where, instead of reinventing the wheel, we leverage existing software assets – components, interfaces, algorithms – across multiple applications”, he says.

He thus expects that companies will fuse IT and operational technology (OT), using data to improve operations.

“Logistics will be a focus area for robotics: like manufacturing, many logistics companies face serious labour shortages while pressure is increasing because of, amongst other, complex multi-channel supply chains. Robots and the smart use of data (thanks to AI, red.) are poised to revolutionise logistics businesses across the whole value chain”, Becker concludes.