Tim Claessens (DHL Express Belux): ‘Expectations “Gen Z” pose major challenges for logistics sector’

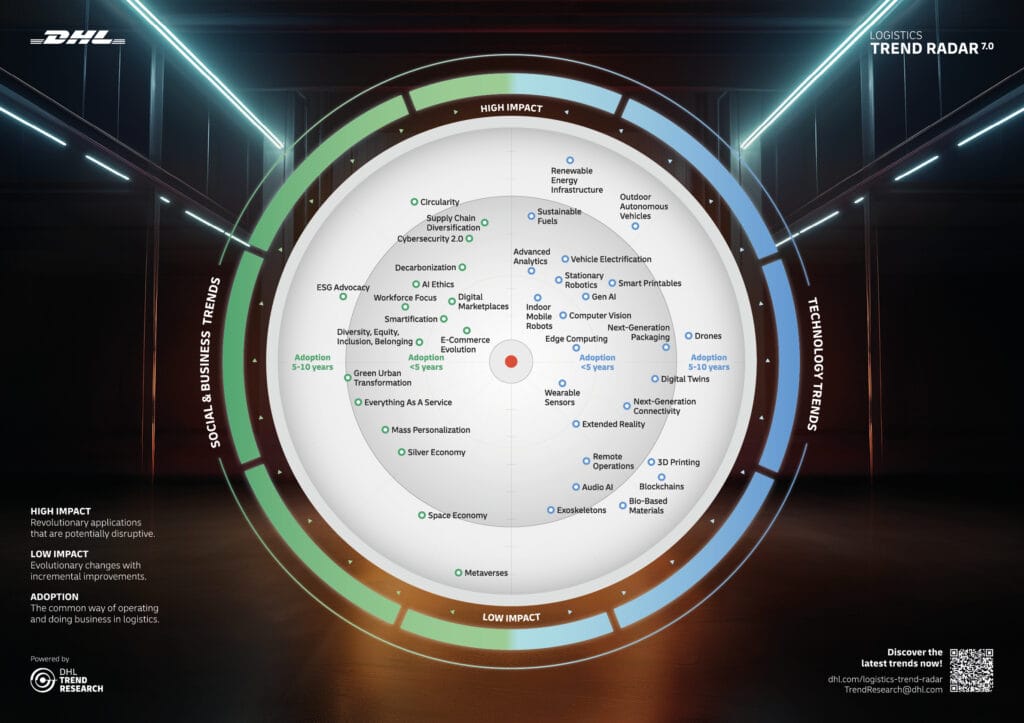

DHL published its Logistics Trend Radar for the seventh time. This bi-annual report describes 40 trends that will affect the industry in the short and long term. From these 23 technological and 17 social and business trends, Tim Claessens, Sales Director at DHL Express Belux, chose three: the increasing use of sustainable fuels, the explosion of e-commerce from China and the impact of the rising generation of workers on company policy.

Since its launch in 2012, the report provides an in-depth analysis of logistics trends, their impact, progression and associated challenges and opportunities. For each, it outlines the predicted time of adoption and their impact on logistics. ‘From those 40 trends, I chose three that already pose challenges for numerous logistics companies today,’ says Tim Claessens.

Sustainable fuel

The decarbonisation trend calls for changes throughout the supply chain. This trend is expected to accelerate, especially with regulations coming into force requiring the reporting of the carbon footprint of products and services.

Electric vehicles are currently a sustainable solution for road transport. However, this is especially true for vans and light trucks travelling short to medium distances, due to their limited range and long recharging times. The development of heavier electric trucks is accelerating, though, and in the meantime, HVO – a biodiesel based on waste products – is a workable alternative.

‘The decarbonisation of road transport is therefore not too big a challenge in itself. That of aviation, on the other hand, is huge,’ Claessens argues. ‘At DHL, for example, 90% of CO2 emissions are generated by aircraft. That is why we are fully committed to Sustainable Aviation Fuel (SAF), which, like HVO, is produced from biological waste products.’

Sustainable Aviation Fuel

SAF is a ‘drop in’ fuel (ed: requiring no changes to aircraft engines) that reduces CO2 emissions by about 80%. However, its production is still small: in 2023, it was around 600 million litres or 5,000 kilotonnes. That’s double the 300 million litres from 2022, but still barely accounts for 0.2% of annual jet fuel demand.

‘Today, DHL is the largest consumer worldwide of SAF. We want to deploy even more, but getting enough SAF requires good agreements with producers. This is why the agreement we recently concluded with Shell for our Brussels Airport operations is so important: the deal, for the period of 1 year, includes the supply of 25 kt of SAF via a pipeline to the airport. This is quite unique worldwide,’ he adds.

Risk of ‘trade off’

SAF is as much as three times more expensive than paraffin, which depresses demand in the market. Today, there is enough SAF available for now, but that will change. Influenced by the ESG and the SBTI (Science Based Targets Initiative), increasingly shippers are finally on board. Their customers – and certainly the millenials – also expect carriers to deploy sustainable fuel. So demand will rise exponentially.

‘This increase holds a big ‘trade off’ risk (ed: a situation where you have to make a choice between two or more things that cannot be optimally realised at the same time). Evidently, our Trend Radar warns that the basic raw materials from waste – frying oil, animal fats, biomass, alcohol, … – will be insufficient to cope with the increase in production, so food crops will still be used. This could affect food security and lead to deforestation, habitat loss and biodiversity decline,’ he argues.

E-commerce from Asia

‘The second major challenge I want to address is the phenomenal growth of e-commerce from Asia and specifically from China. Volumes from TEMU, SheIn, TikTok Shop and other merchants are rising disproportionately. This poses a huge ‘compliance’ risk. There is a lot of counterfeiting and often the products do not meet our safety standards. There are also goods that are not ethically produced,’ says Claessens.

‘Many young people say they want to buy sustainable products, but often have no problem with these practices. For transporters – and the whole supply chain actually – this increases the risk of liability problems. We therefore expect regulations to become stricter and more controls to stop such products. However, this threatens to have an impact on supply chains in general,’ he claims.

Other expectations

Claessens expects another evolution in the field of e-commerce or at least influenced by it: ‘Gen Z has become used to ordering on B2C platforms without much effort and formalities and being delivered almost immediately. This generation is now increasingly entering management roles. That will have a fundamental impact on how companies trade and thus supply chains.’

‘They no longer want to order and be delivered in the traditional way, but expect B2B platforms with easy processes and little administrative fuss – in their own language -, instantly generated invoices, short delivery times, and deliveries at the time that suits them. For manufacturing and trading companies and their logistics partners, this will have a major impact,’ he says.

The B2C sector is much farther in this regard, but B2B will have to follow. ‘A big challenge will be delivering at times that customers decide. Your delivery van or truck cannot simultaneously deliver to Roeselare and Ghent at 10 o’clock on Tuesday. So carriers will have to have more scale to consolidate more loads. DHL Express has that scale and we pretty much always drive full capacity, but for smaller players the challenge is great.’

Tensions between white-collar and blue-collar workers

A third trend highlighted by Claessens is ‘Workforce Focus’. This refers to prioritising the needs, wants and well-being of employees as the basis for organisational success.

According to him, Workforce Focus – a global phenomenon – will significantly change working conditions in all sectors. So also in logistics. Evidently, young employees have many expectations in terms of ‘work-life balance’, ethics, sustainability, technology (having the right tools to work), flexibility and so on.

‘Meeting all these expectations is a challenge, especially because some of them can even lead to conflict. Take flexibility: white-collar workers expect to be allowed to work from home often. For a worker – a warehouseman, a driver, a courier – working from home is by definition out of the question. That can lead to tensions between the two groups.’

‘Transformational leadership’

The new generation not only has more expectations, it is also more assertive. It is becoming harder for the business manager to impose working methods. Young people expect to be explained why something should be executed one way or the other. They also expect to be able to give input. So a cultural shift is needed to move from a task-oriented or management-oriented culture to one that prioritises employees’ needs and well-being.

‘But balancing employee centricity with other values such as effectiveness and productivity can be challenging, especially in Operations. That is why ‘transformational leadership’ is expected to increasingly become prevalent and quietly become the norm. Unless in cases of crisis, of course,’ he concludes.

The DHL Logistics Trend Radar 7.0 is available as an interactive website at www.dhl.com/logistics-trend-radar. You can also download a PDF version there.

DHL Express

Want to know more about our innovation partner? Click the following link to learn everything about DHL Express.